LegalTowns can now be found at http://www.legaltowns.com.

LegalTowns can now be found at http://www.legaltowns.com.

All new posts will be made at the new URL.

Please update your bookmarks!

LegalTowns can now be found at http://www.legaltowns.com.

LegalTowns can now be found at http://www.legaltowns.com.

All new posts will be made at the new URL.

Please update your bookmarks!

Posted in Uncategorized |

Source: NYPL Digital Archive

I’m happy to report that The American Conservative, in its New Urbs feature, has just published my article about the land-use efficiency of New York’s turn-of-the-century apartment houses. My piece focuses on the period before zoning — although building safety codes did impose some limits on construction — with an eye to the simple, practical measures such as courtyards and alleyways that builders of the time used to make efficient use of small parcels — and to make room for more people to live comfortably in New York City. Hope you enjoy.

Source: NYPL Digital Archive

Posted in Uncategorized |

Incredible. The Museum at Eldridge Street, located near the base of the Manhattan Bridge is a restored 1887 synagogue — the first house of worship built by Eastern European Jews in New York City. The block on which it is located is now very much Chinatown, but in the late 19th century it was at the heart of the Jewish Lower East Side.

The synagogue was almost lost to abandonment in the 1970s, but has now been meticulously restored. I walked in on a lunch break last week, expecting just to look around and take some pictures. Instead, I was lucky to coincide with a scheduled tour with an incredibly knowledgeable docent, Ester, who told the story of the congregation from its founding in the late Victorian period through the neighborhood’s transition, the synagogue’s decline, and finally the building’s beautiful restoration.

The blue stained-glass window is recent; the rest of the details are original. Most of what looks like marble or masonry is actually wood. Very much worth a visit.

Posted in Uncategorized |

Click on the above photo to see my full album.

My favorite of the city’s Art Deco skyscrapers, this soaring Pine Street tower was built as the headquarters of the Cities Service Company, predecessor of Citgo. The Cities Service logo — a pyramid within a cloverleaf, usually black or green in trade dress — can be found pervasively worked into the concrete and metal exterior details, and the interior details, as well. Designed by architects at Clinton & Russell and Holton & George, the 952-foot tower opened in 1932.

My favorite of the city’s Art Deco skyscrapers, this soaring Pine Street tower was built as the headquarters of the Cities Service Company, predecessor of Citgo. The Cities Service logo — a pyramid within a cloverleaf, usually black or green in trade dress — can be found pervasively worked into the concrete and metal exterior details, and the interior details, as well. Designed by architects at Clinton & Russell and Holton & George, the 952-foot tower opened in 1932.

Last year, I posted a batch of pictures that I had taken of the exterior details at ground level; and of the tower within the skyline of Wall Street. It is a striking tower, sleek and tapered at the top. But given the dense cluster of tall buildings that now characterize the neighborhood, it is a challenge to find a clear shot of more than its very top. Fortunately, an outside detail (above) provides a scale model of the complete tower in clean, white concrete — like the building itself.

A residential conversion was recently completed, which includes a beautiful top-to-bottom restoration of the landmark skyscraper. I doubt the building could have looked much sharper in 1932, when it opened amid the Great Depression, having been on the drawing board before the fortunes of Wall Street turned dark. The redeveloper, Rose Associates, has really done an incredible job.

Here, I include a number of new pictures of the grand lobby, the basement, and various stairwells and corridors.

Hope you enjoy. I love this building, and think you will, too.

Posted in Lower Manhattan, Spotlights |

Hard to believe that it has been 16 years since that morning. I was in my second year of college at The New School. A few lines from a piece that I wrote shortly afterwards (mostly, just for myself, so that I would later be able to remember exactly what I’d experienced):

I went upstairs to class and took a seat. My advisor, Henry, was already there, getting organized. A minute later the second professor showed up. A small argument ensued between the two.

“Do you know what’s going on out there?” said Stuart.

“Yes, but I think we need to go on with class,” said Henry.

“A lot of people are out there watching…. We may not have everyone.”

“Well, I’m not much for that. We should go on with who we have.”

“Well, it’s pretty hard not to watch … the fucking World Trade Center is on fire. Another plane just crashed into the South Tower.” Everyone in the room was jarred.

“Oh my God. Some kind of … attack?”

“Oh yeah, it’s definitely an attack.”

“Well, what do you think? I mean, it’s important … but I think what we are doing here is important, too.”

“That’s true.”

“I mean poetry isn’t the least important thing.”

“No, definitely not. I guess we should go on.”

“Yes, I think that would be the right thing to do.”

Later, after the class had finally been dismissed:

I turned left and walked on through the grid of streets, up through the warehouses and housing projects beyond Ninth Avenue. I wasn’t sure where I was going; I just gravitated in what seemed to be the right direction. I lived in Brooklyn Heights that semester, but I was walking the opposite way. Getting back to my room would have involved either a long detour through Williamsburg, or a trip straight through the scene. Instead, I thought I might have to walk all the way to my uncle’s apartment on 207th Street — and I didn’t know if anyone would be home, if I did.

I managed to stay cool-headed, but I was really unsure of what I should do. I kept going north and west. Getting out of the heart of the city seemed like the main idea. At some point, it occurred to me that a ferry might be crossing to New Jersey, so I made my way west to the Hudson River. If I went back to the town where I had gone to high school, I would find someone to put me up overnight. It wasn’t far away; just across the river from the city. But it was a different world. By that point, I was sure that I didn’t want to go back to Brooklyn….

There were thousands of people walking up Twelfth Avenue. Most of them had walked all the way up from the site. People were sort of talking to each other briefly and moving on. It was strange. You don’t usually talk to strangers in a moving crowd, but everything was different then. Normal street smarts seemed useless. The ethos of minding your own business and ignoring anything out of the ordinary? I knew that would not work anymore. But how could you replace it with something else?

There was a middle-aged man in a suit who told me he worked at the World Financial Center. His hair and jacket were covered with gray ash. When the first plane smashed into the North Tower, he began to leave, but his boss said, in all seriousness: “That’s a World Trade Center problem. This is the World Financial Center. Get back to work.” I laughed, and he moved on.

There’s more, but it’s not really in any shape to be posted. Maybe one day I’ll clean it up and share it here as a single piece of writing.

Posted in Lower Manhattan |

Click on the above photo to see my full album.

Just some pictures from a couple of trips to New York City beaches this summer. Honey and I made it to Rockaway Beach on an absolutely beautiful day, in early August. The ocean was about as blue as you could imagine, and the beach has been completely remade with white sand and a new boardwalk, replacing the one that was destroyed during Hurricane Sandy. The little things in the photos that look like pebbles are actually tiny clams, coming in by the thousands that day with each wave, then burrowing their way into the sand when the water went out. It was really something to see.

About a week later, I wound up on a work-related field trip to the coastal parts of Brooklyn, to observe the progress that my program has made in rebuilding private homes in Gerritsen Beach, Sheepshead Bay, and Coney Island. We were supposed to have a happy hour afterwards on the Coney Island Boardwalk, but it was cancelled because of the intermittent (but occasionally heavy) rain. The neighborhood was eerie and abandoned, with wet streets and empty sidewalks. I thought it was photogenic. It’s interesting to me how many of the individual artifacts of the Coney Island my grandparents would have visited are still there — Nathan’s, Luna Park, the Cyclone; and even more interesting, from a planner’s perspective, that this famous seaside spot has never been redeveloped.

At the end, I included just a few pictures of the work that our program is getting done in the Sandy-affected parts of Brooklyn. It has been a long process getting to a point where physical progress can been seen in these places. Everyone who has been involved in since 2013 should be proud of what he or she has done, especially the homeowners and tenants who have stuck with it for the long haul.

Posted in Building Codes, Late Victorian, Spotlights |

A bunch of green acorns just caught my eye while walking in Eagle Rock Park. Interesting how subtly the shapes of nature were incorporated into the standard forms of traditional 19th century urbanism. A lot of the old street lamps look like flowers. I think its an artifact of the mainstreaming of certain elements of cultural Romanticism by the late Victorian period.

Posted in Art, Late Victorian |

I’m happy to report that The American Conservative, in its New Urbs feature, has published my article about the key factors that shaped Late Victorian urbanism in the United States. My piece focuses on this period before zoning, and explores the physical, legal, economic, and cultural phenomena that drove neighborhood development in the absence of comprehensive plans. I chose this period because it has intrigued me for a long time; and because so much of the New Urbanism of today seems to be imitating the forms of that era without necessarily asking the important questions about the larger context that created them. TAC deserves credit for taking a lead in discussing the important dynamic between urban form, society, and sustainable communities. Here’s a nice piece by executive editor Lewis McCrary about the walkability of New Jersey shore towns, many of which I have walked through, and many of which have an urban fabric that dates from the same period that my article describes.

Posted in Books & Articles, Common Law Urbanism, Late Victorian, Law, Planning Theory |

Click on the above photo to see my full album!

My office is just across Park Place from the landmark Woolworth Building. Once the world’s tallest skyscraper, the whimsically Gothic tower still dominates the western edge of New York’s town green. Back in the fall, I took a guided tour of the lobby — which is otherwise off limits — which turned out to be a pretty incredible experience. Here are some pictures.

Would definitely recommend to anyone with an interest in the building itself, early skyscrapers, tesellation and mosaics, the transition from classical to modern architecture, or just the history of American business. The colors are incredible. Likewise, the masonry and marble. Photos in my album begin in the main lobby, then move to the back of the main floor, down into the basement (where a lost entrance to the subway can be found, sealed off), and finally up to the balconies, where you can almost touch the tiled ceilings.

Posted in Common Law Urbanism, Lower Manhattan, Spotlights |

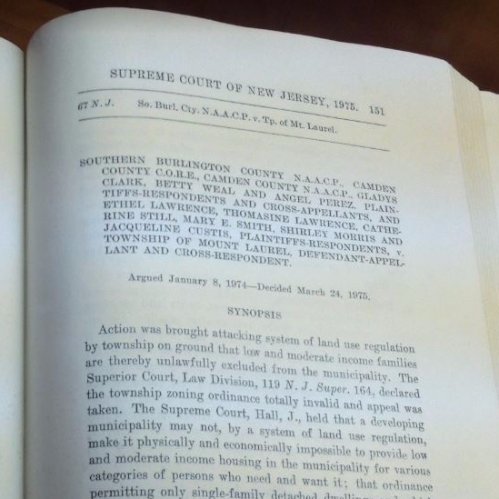

Click on the above photo to see the full album.

Here are some pictures I took of a special exhibit at the Rutgers Law Library in 2013, focused on the Mount Laurel doctrine, its history, and its legacy. I just discovered them while I was going through old photos, and thought they might be of interest to some readers. Incidentally, I was in John Payne’s Con Law class during his last semester of teaching at Rutgers. His untimely death was jarring for those of us who were in his class. Interesting fact: he and his wife lived in a Frank Lloyd Wright house, in Glen Ridge.

Posted in Housing / Limited Equity, Individual Rights, New Jersey Law, Spotlights |

You must be logged in to post a comment.